Quickly and easily convert your tax refunds into utu Vouchers and get more spending power to purchase the things you love.

What are utu Vouchers?

utu Vouchers boost your spending at our partner stores or Duty Free.

Pre-pay for a voucher and we’ll increase its value by 20% to 100% at participating stores – your ‘tourist bonus’.

Available to tourists who have been tax-free shopping and have a valid tax refund form or receipt that is less than 12 months old.

*The % varies from participating stores.

How are utu Vouchers created?

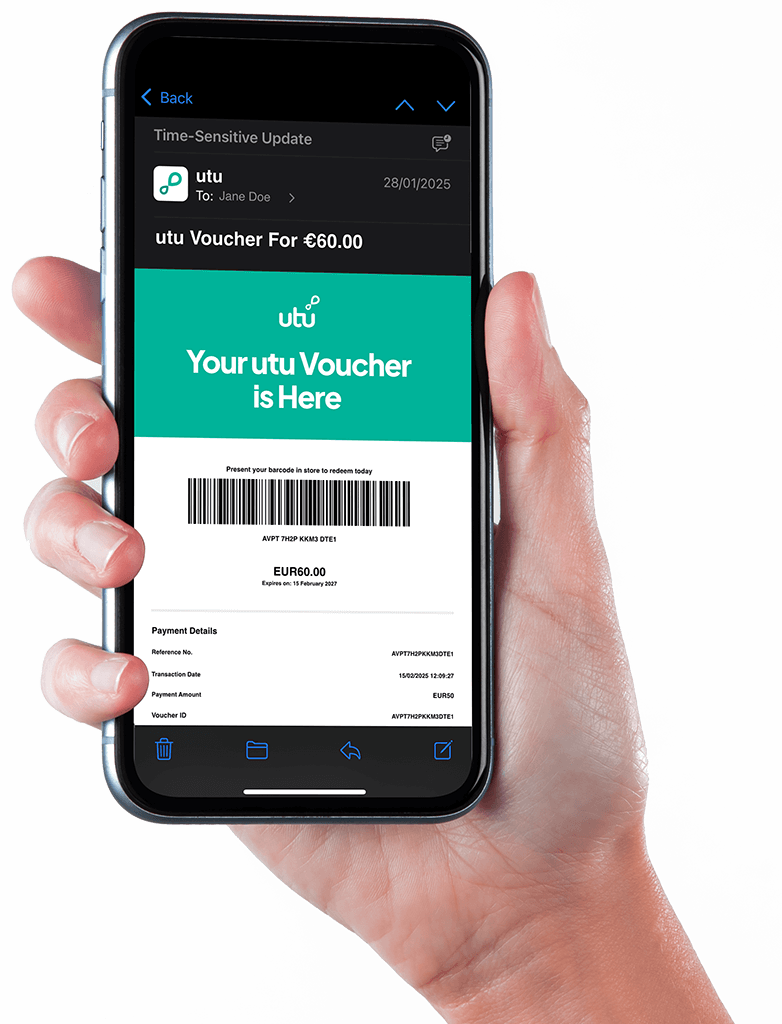

You take a photo of your tax refund form using our web app. The app recognizes the value of the refund and gives you the option to buy the voucher.

How you can maximize your tourist bonus

The key to getting a bigger tourist bonus is to decide where to buy your utu Voucher and which tax refund form or receipt you use during the process.

Same store

Get up to

Tourist Bonus

During your trip, you can convert your tax refund from your first purchase into a utu Voucher and spend it on a second item in the same store. You’ll receive up to 100% bonus on your refund value.

Different store

Get up to

Tourist Bonus

Typically, receive a 35%-50% bonus when using a tax refund from a different store to be used as a utu Voucher at one of our partner stores.

Duty Free

Get up to

Tourist Bonus

Get up to a 20% bonus to spend at Duty Free when you purchase your utu Voucher at the airport.

Please note: the percentage bonus varies in different countries and stores

When shopping in the city

Enhance your tax-free city shopping with utu Vouchers.

Already saved some from your recent handbag purchase at an outlet mall? Get more out of your tax-free shopping journey when you buy the matching wallet with utu boosting your tourist bonus every step of the way.

At the Airport

End your trip in style with last-minute shopping at Duty Free.

Whether you’re picking up a signature fragrance, a bottle of champagne, or a last-minute gift, utu Vouchers give you more value on your tax-free purchases.

FAQ’s

Yes, the utu voucher is valid for 14 days from the date it is issued.

No, the introduction of utu does not alter the standard VAT refund procedure at the airport. You must still follow the traditional process to receive your base refund.

You can generate the utu voucher using widely accepted payment cards.

No, the voucher cannot be split. It must be redeemed in its entirety at the specified store where it was issued.