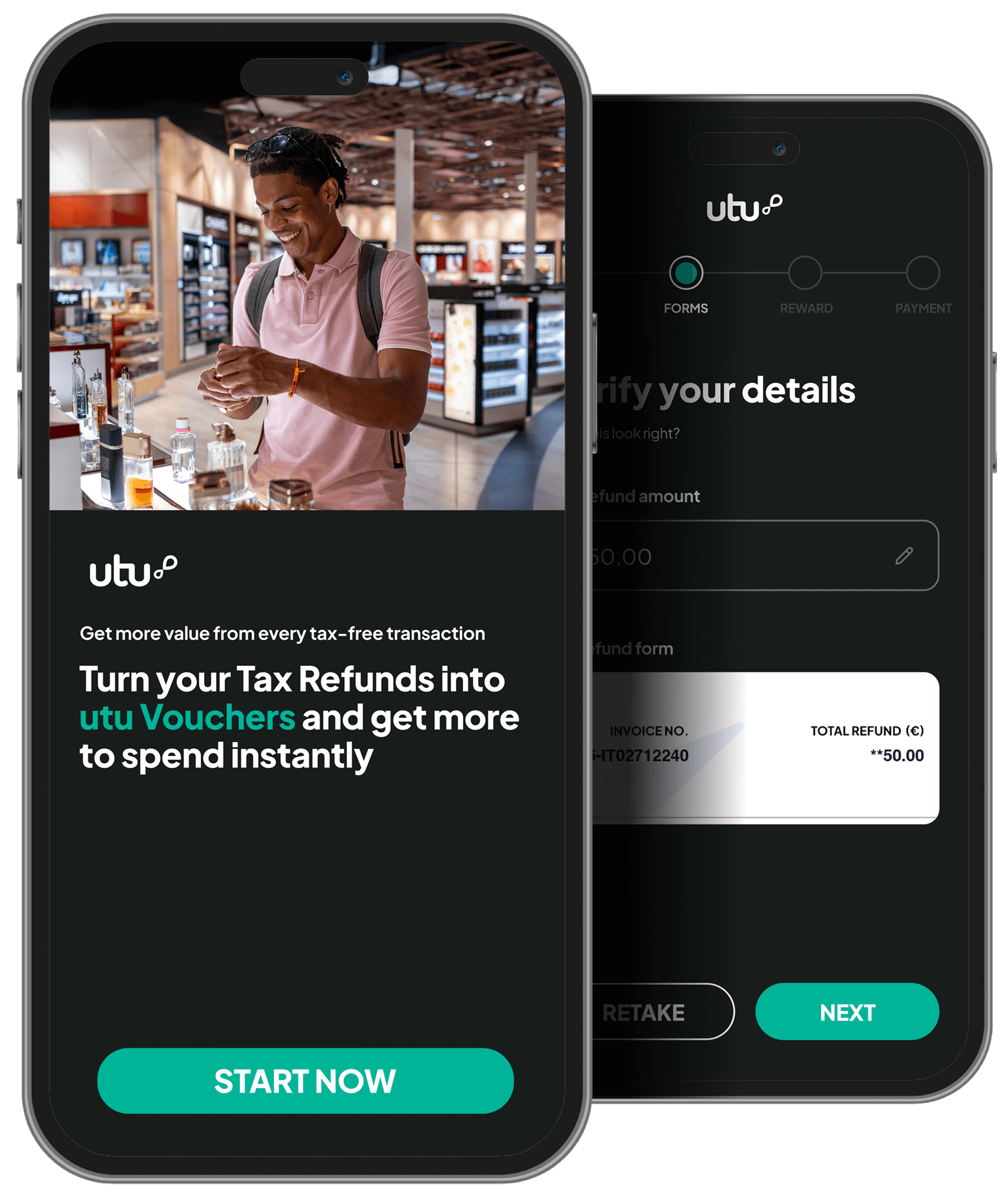

Increase your spending power the next time you shop tax-free by converting your refund into a utu Voucher. You’ll get between 20% and 100%* extra to spend. Plus, it’s quick and easy.

* The % varies from participating stores

How to turn your tax refund into a utu Voucher and get more to spend.

Claiming the tax back on items you buy while on vacation is a great way to save money. But why not reinvest the money you saved and buy a utu Voucher? With the voucher, you’ll get between 20% and 100% more to spend as a tourist bonus.

Have your tax refund form or tax receipt to hand

It all starts with your overseas tax-free shopping refund form or tax receipt. You’ll need this ready when you launch our clever AI-powered web app.

Decide where to

get your voucher

Our web app recognizes the value of the tax refund and offers you the option to buy a utu Voucher. The bonus amount will depend on where you buy the voucher.

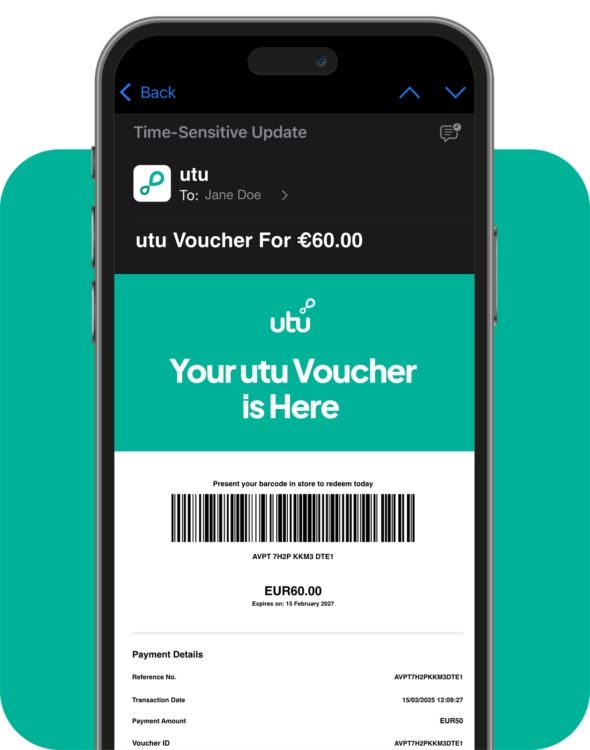

Get and spend your

voucher instantly

The voucher appears on your phone instantly and by email, showing its value and the amount of your tourist bonus.

It’s a no-brainer and here’s why

In this example, you have your eye on a bottle of perfume at a Duty Free store for €150

You know the perfume you want and how much it costs. Rather than buying it outright, you convert your tax refund into a utu Voucher, unlocking your tourist bonus.

Your utu Voucher is now worth 20% more. Making it much more attractive to buy the perfume.

With utu’s tourist bonus

Price of perfume €150

Cost of voucher €100

Receive 20% tourist bonus +€20

Extra to pay at checkout Only €30

Turn your tax refund into a utu Voucher and get your tourist bonus.

What is a tourist bonus?

It’s the extra spending power we give you when you buy a utu Voucher. Each voucher automatically gives you more to spend. Buy and use a voucher in the same store and get 100% more to spend. Buy one at the airport to use at Duty Free and you’ll get 20% more.

FAQ’s

Yes, the utu voucher is valid for 14 days from the date it is issued.

No, the introduction of utu does not alter the standard VAT refund procedure at the airport. You must still follow the traditional process to receive your base refund.

You can generate the utu voucher using widely accepted payment cards.

No, the voucher cannot be split. It must be redeemed in its entirety at the specified store where it was issued.